What Does Medicare Advantage Agent Do?

What Does Medicare Advantage Agent Do?

Blog Article

The Basic Principles Of Medicare Advantage Agent

Table of ContentsMedicare Advantage Agent Fundamentals ExplainedThe 7-Second Trick For Medicare Advantage AgentWhat Does Medicare Advantage Agent Do?How Medicare Advantage Agent can Save You Time, Stress, and Money.A Biased View of Medicare Advantage AgentGetting My Medicare Advantage Agent To Work

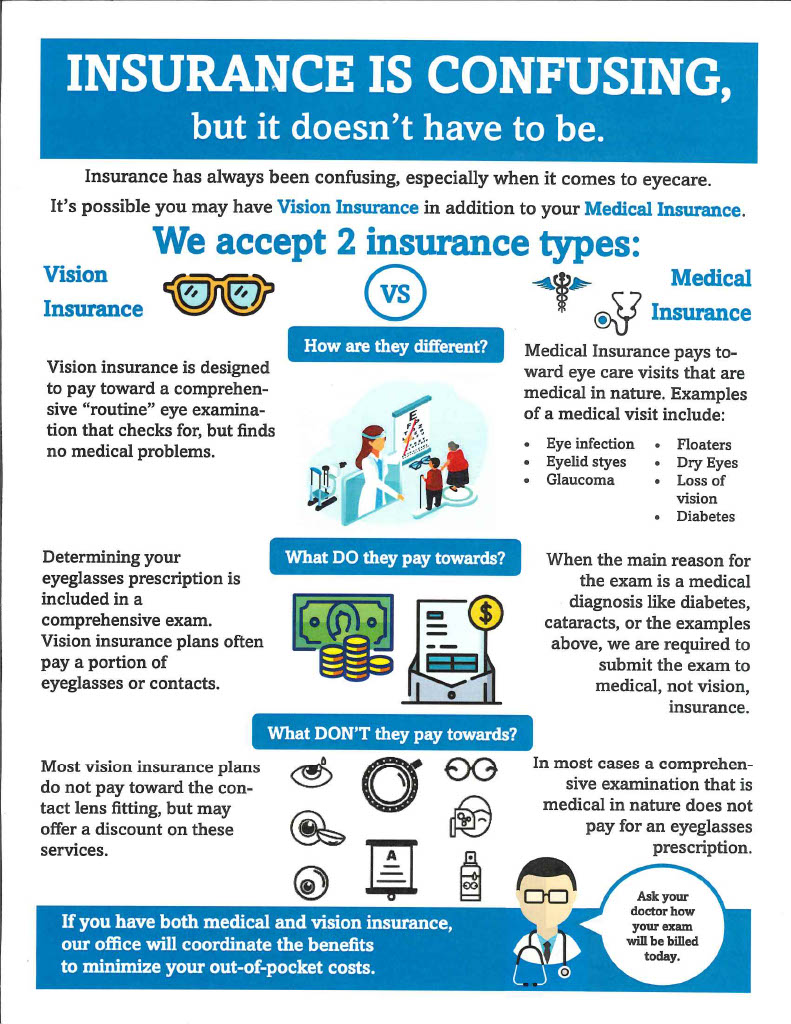

If the anesthesiologist runs out your health insurance's network, you will certainly obtain a surprise bill. This is also understood as "balance payment." State and federal regulations shield you from surprise medical bills. Figure out what costs are covered by shock invoicing regulations on our page, Exactly how consumers are protected from shock medical costs For more details about getting assistance with a surprise costs, see our page, Exactly how to obtain assist with a surprise clinical bill.You can utilize this duration to join the plan if you didn't previously. Plans with greater deductibles, copayments, and coinsurance have reduced costs.

Know what each plan covers. If you have doctors you desire to maintain, make certain they're in the plan's network. Medicare Advantage Agent.

Things about Medicare Advantage Agent

Make sure your drugs are on the strategy's listing of authorized medicines. A plan won't spend for drugs that aren't on its list. If you lie or leave something out purposefully, an insurer may cancel your insurance coverage or refuse to pay your claims. Use our Health insurance buying overview to go shopping clever for wellness protection.

There are separate warranty associations for different lines of insurance coverage. The Texas Life and Health Insurance Warranty Association pays insurance claims for wellness insurance. It will pay insurance claims approximately a dollar limitation established by legislation. It does not pay insurance claims for HMOs and a few other kinds of strategies. If an HMO can't pay its claims, the commissioner of insurance can designate the HMO's participants to another HMO in the area.

Your partner and kids also can continue their coverage if you take place Medicare, you and your spouse separation, or you pass away. They have to have gotten on your plan for one year or be younger than 1 years of age. Their insurance coverage will certainly end if they obtain other coverage, do not pay the premiums, or your company quits providing health and wellness insurance coverage.

The Ultimate Guide To Medicare Advantage Agent

If you continue your coverage under COBRA, you must pay the costs on your own. Your COBRA insurance coverage will be the exact same as the protection you had with your employer's strategy. Medicare Advantage Agent.

Once you have signed up in a health insurance, make certain you comprehend your strategy and the expense effects of different treatments and solutions. Going to an out-of-network medical professional versus in-network commonly sets you back a customer much more for the go to this web-site very same type of service (Medicare Advantage Agent). When you enlist you will certainly be provided a certificate or evidence of coverage

The Facts About Medicare Advantage Agent Uncovered

It will likewise tell you if any kind of solutions have restrictions (such as maximum quantity that the health insurance plan will certainly spend for resilient clinical equipment or physical therapy). And it needs to inform what services are not covered whatsoever (such as acupuncture). Do your research, research all the alternatives offered, and evaluate your insurance coverage prior to making any kind of decisions.

An Unbiased View of Medicare Advantage Agent

When you have a clinical procedure or go to, you normally pay your health and wellness treatment company (physician, medical facility, specialist, and so on) a co-pay, co-insurance, and/or a deductible to cover your part of the copyright's bill. You expect your health insurance to pay the remainder of the bill if you are seeing an in-network supplier.

Nonetheless, there are some instances when you might have to sue on your own. This could happen when you most likely to an out-of-network service provider, when the copyright does decline your insurance my sources policy, or when you are taking a trip. If you need to file your own wellness insurance case, call the number on your insurance card, and the customer assistance representative can notify you exactly how to sue.

Many health insurance plan have a time frame for how long you have to sue, commonly within 90 days of the solution. After you file the case, the health insurance plan has a minimal time (it varies per state) to inform you or your supplier if the health insurance plan has approved or rejected the insurance claim.

The smart Trick of Medicare Advantage Agent That Nobody is Talking About

For some health and wellness strategies, this medical need decision is made prior to therapy. For other health and wellness plans, the decision is made when the company gets a over here costs from the company.

Report this page